WHY AMPLIFIER IS THE SMART CHOICE

FOR YOUR Austin FULFILLMENT NEEDS

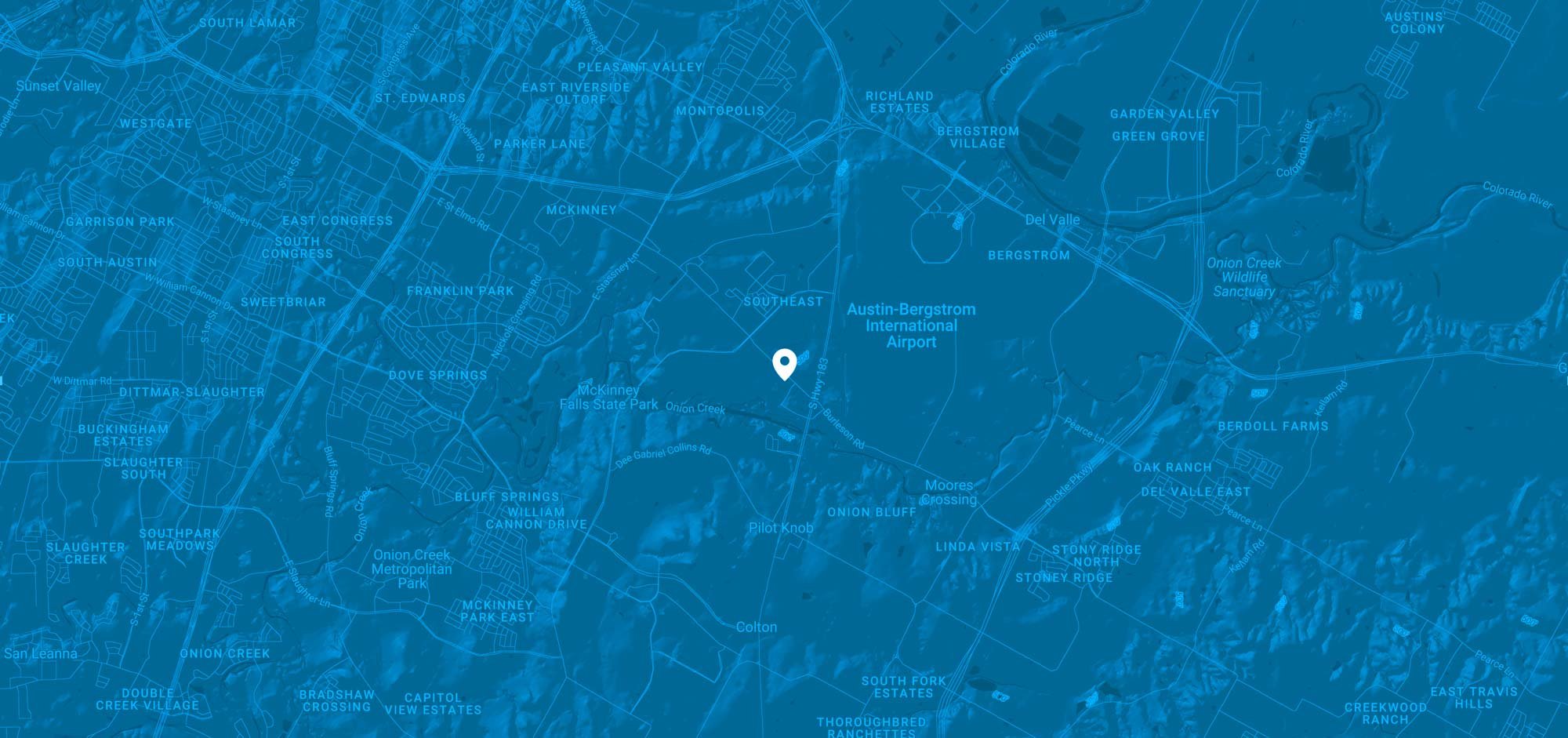

When picking a fulfillment partner in Central Texas, Amplifier stands out. Our 100K+ sq/ft warehouse is strategically located in a Triple Freeport Tax zone which can mean significant savings for your growing e-commerce business.

What is the Triple Freeport Tax Exemption?

The Triple Freeport Tax Exemption refers to a tax benefit available in Texas, including the Austin area, that allows businesses to be exempt from paying property taxes on certain types of goods, provided those goods meet specific criteria. The "Triple" part refers to the fact that this exemption can apply to three different types of taxes: county, city, and school district taxes.

Property Taxes on inventory can be a non-trivial cost to businesses operating in Texas. So the prospect of evading them for almost six months is a rich one indeed.

To qualify, your e-commerce inventory must be:

Acquired / imported into Texas

The goods must be brought into Texas for storage purposes.

Held temporarily IN TEXAS

The goods must be stored for a short period—usually less than 175 days

THEN Shipped out of Texas:

The goods are then shipped out of state, often as part of a business's supply chain.

.